Table of the Week

This week, the European statistics agency, Eurostat published the latest GDP data for the EU and selected non-EU countries. Nine of the 27 EU countries are clearly in recession with two successive quarters of negative GDP growth, but as we know on here, Ireland too is in recession because although its change in Q4,2012 was officially logged as 0.0% or -0.0%, it is actually -0.047% which confirms a second quarter of GDP contraction.

Salaries of the Week

This was the week that we learned the last accounts for the Irish Film Classification Office were for 2009 and that subsequent accounts hadn’t been filed “due to an oversight”. We learned this week that the latest accounts filed for Ireland’s woeful Competition Authority were for 2010 and are available here. No word on subsequent years. We learned that the average salary for the 46 staff in the Competition Authority, comprising four board members, 38 staff and four secondments from other Government departments was an impressive €68,600 in 2010. Furthermore, the relatively small operation ran up unspecified – no, not building or travel or printing or advertising – administration costs of €139,000 and IT costs of €104,000. Overall, the operation cost us €4.4m in 2010. Its outputs are less impressive, it certainly deals with notifiable mergers but I cannot see evidence of robustly rejecting a merger, ever. There are a tiny number of prosecutions for competition infringements, and yet, we continue to live in a State where medicines are several times more expensive than in the neighbouring jurisdiction, our lawyers are still the second most expensive in Europe after Moscow, our recession-racked economy still tolerates €500-1,000 per hour payments to professions. And don’t even get me started on consumer goods, from groceries to mobile phones.

Quote of the Week

“It really does make me ashamed of my government when they can get wages in the hundreds of thousands annually, but when one of the most important children’s wards in Ireland, for some of the sickest kids in Ireland, has to rely on charitable donations to buy a bucket of paint and a brush. That is one of the sickest things I have ever come across in my short lifetime here” 16-year old Kerry man Donal Walsh who lost his fight with cancer last weekend – in his own words he wrote about dealing with cancer, they’re worth a read here and here.

Rubbish of the Week

A month ago, amid widespread illegal dumping in the Gardiner Street area of Dublin, Dublin City Council was threatening not to collect rubbish from certain areas of the city and let the residents resolve the problem of illegal dumping themselves; how, wasn’t clear but it had hints of a call for vigilantism but in the end, DCC abandoned that hare-brained scheme but have now introduced another – over a week ago, they confirmed they were writing to local authority tenants demanding proof that they had paid for a waste disposal provider. And it seems DCC is even proposing to extend this new scheme to allow its officials knock on anyone’s door to demand proof of having engaged a provider.

Curse of Dragons Den of the Week

The “curse of Hello” where full colour splashes of celebrity lives in the pages of Hello magazine, only to be soon followed by banana skins, revelations of peccadillos and tragedy, seems to have spread to the Dragons Den, the Japanese TV format created which was picked up by the BBC and latterly by RTE. In Ireland, we have seen Dragons Bill Cullen’s motor dealership and hotel operation fall from grace, and more recently Niall O’Farrell’s chain of formal wear and suit hire shops fall victim to the ongoing recession. In the UK this week, the Daily Mail suggested that one of the stars of the UK version of the show, Duncan Bannatyne was facing money troubles, though the scrappy Scotsman was quick to tweet that the Daily Mail story was untrue.

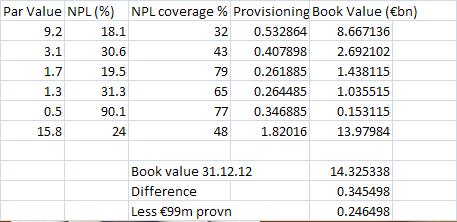

Table of the Week

This week, the NTMA produced its monthly “Ireland has turned the corner” presentation to investors with its laughable spin on an economy still in recession, with 14% unemployment, with retail sales declining (fast), with commercial property rents and capital values declining, with residential property declining, the NTMA still manages to appear positive. Its openness proxy is a good one – this adds together exports (X) plus imports (M) and divides the sum by GDP. In Ireland’s case, we are amazing compared to the other PIIGS, but this ignores the massive in/out flows from multinationals which is a unique feature of the Irish FDI-focussed economy. Anyway, good to know residential property rose for the first time since 2007…..

Old Media swan song of the Week

“Sarah McInerney of The Sunday Times acknowledged that the online version of that newspaper’s Irish edition which she said was known within the company as the “regional edition”, was “not doing well”.” So reported the Irish Times this week

We also had UTV’s management statement for Q1,2013 which noted that its commercial radio operations in Ireland (north and south) were down 8% in Q1,2013 compared to a year previously. That’s a worrying decline for a company that is well regarded commercially but more worrying was the statement “We believe that we continue to outperform the market” which doesn’t bode well for competitors here, particularly RTE and Communicorp (Newstalk and Talk amongst others) and Landmark Enterpises (the Crosbie vehicle that has taken on the operation of local radio interests previously managed by TCH).

We also had Johnston Press’s management statement for Q1,2013 – you might ask where are the statements for Irish-owned companies but apart from IN&M indicating revenues were down 10% this year on last, we haven’t heard a mig from our own. Johnston Press publishes 12 local titles in Ireland – Donegal Democrat, Donegal People’s Press, Dundalk Democrat, Leinster Leader, Leinster Express, Leitrim Observer, Longford Leader, Kilkenny People, Limerick Leader, The Nationalist and Munster Advertiser, Tipperary Star and The Echo in Tallaght. Although total revenues were down 11.4% in Q1,2013 from a year previously, it seems the decline is concentrated on advertising and that circulation revenue had held up.

Resemblance of the Week

Colourful Independent TD for Roscommon, Luke “Ming” Flanagan turned up at the Dail this week, a-la-Paris Hilton, with a tiny dog in tow. Julie, which could be a Scottish Terrier but could be some lovable Roscommon-Leitrim mongrel. Perhaps one of these days, the old media might run a feature of politicians and their dogs to judge if owners indeed chose dogs in their own reflection.

Parliamentary insult of the Week

“In truth I have to say that I am fed up to the back teeth with the foot dragging, the whinging, the stalling; sometimes, you might even say the attempt to politically posture on critical issues such as this; the begrudging, the bellyaching that you hear, the conditioning before statements can go out from colleagues. And I’m depressed listening to a tribe of Jeremiahs that infest the political process and whose first thought is to attack any genuine attempt that is made for positive proposals. And those people of course have nothing to contribute themselves. And I also have to say that I get glum at the whited sepulchers who pontificate to us about a shared society and talk to us about harmony and consensus politics and yet, unless they are taking the lead themselves and are taking everything they want, they strain and stretch every sinew to abstain and obstruct what is going on. And quite honestly Mr Speaker, I think we have reached the stage that if we wait for the last person to board the train, the train will never leave the station“ Peter Robinson, First Minister of Northern Ireland, in the Stormont Assembly responding to criticism of the joint Sinn Fein/DUP “Together: Building a United Community”

Let’s hope Peter’s grasp of the political challenges facing Northern Ireland is better than his grasp of the Good Book. The prophet Jeremiah may well have forecast doom-and-gloom but as it turned out, his predictions were accurate. And a day or two later, the TUV picked up on this when they issued a statement

“Yesterday the co-First Minister branded his critics in the Assembly “a tribe of Jeremiahs”. The image struck me as an exceptionally odd form of insult, particularly as the warnings proffered by Jeremiah proved to be accurate. Given the traffic chaos which is developing at the Maze it is obvious that the warnings of some Jeremiahs have been well founded.”

Tax Home Truth of the Week

“The art of taxation consists in so plucking the goose as to obtain the largest amount of feathers with the least possible amount of hissing” Jean-Baptiste Colbert, finance minister under Louis XIV in 17th century

Okay, it’s not new but the general absence of hissing over the property tax – yes, there have been a few marches, a handful of occupations but the indications from the Revenue Commissioners is that the tax has been accepted far more widely than its predecessor, the household charge. This time around, the Government has firmly passed responsibility for the tax to the still-generally-feared Revenue Commissioners, it has a 50% discount in place for 2013 and despite it being a deeply unfair tax in many respects, it seems as if it is on track to be accepted by a considerable majority by the filing deadline – 28th May 2013.

Act of Transparency of the Week

In Uganda, a country with a land area three times that of Ireland, and a country to which we provide foreign aid, this week, they achieved a fully computerized Land Registry showing who owns what. Amazing. In Ireland, we haven’t quite registered all property yet, and there is a sizable amount, particularly in south county Dublin, apparently, that has yet to make it online. So, you just have to wander up to the dusty Public Records Office on Constitution Hill in Dublin and pay your €15 for a photocopy.

Whitewash of the Week

The vehement disdain towards the “anonymous author” that blew the whistle on Garda malpractice in quashing traffic penalty points, was not well disguised. Nor was the anonymous author whom we’ve all known for some time was John Wilson. The report itself is here and there is a lengthy additional report on what the Garda practices are. Heads are still being scratched at how seven separate notices being quashed for the same family didn’t rise to the level of corruption. But mostly we wanted to know why the Gardai were investigating themselves when we have a perfectly good Garda Ombudsman set up for such investigations. Three Gardai face disciplinary action, the report will now be examined by the Oireachtas justice committee but the Garda Commissioner and Minister for Justice Alan Shatter are desperate to draw a line under the whole affair and calls by Transparency International for better protection of whistleblowers seem to have fallen on (the) deaf ears in Officialdom.

Response to debt demand of the Week

And finally, Clare Dooley whose Twitter profile says she assists people suffering in the economic downturn provides a novel approach to demand letters from the banks.