“These are challenging times for the whole banking sector in Ireland, not just for the domestic banks. KBC Ireland is an important provider of credit to the Irish housing market and as the Deputy rightly points out the Bank has extended some €14 billion of credit to the Irish economy.” Minister for Finance Michael Noonan on 23rd April, 2013

This morning KBC Ireland, one of the few non state-owned retail banks operating in Ireland, released its management statement for the first three months of 2013. There is a separate presentation to analysts here and Ireland is detailed on pages 62-64. Here’s what we learn:

(1) Loss after tax and impairment provision of €77m in Q1,2013 compared with €148m in Q1,2012

(2) Mortgages in arrears have risen from 17.5% of the principal residential loanbook at the end of 2012 to 18.1% today.

(3) Mortgages in arrears have risen from 29.2% of the buy to let loanbook at the end of 2012 to 30.6% today.

(4) Impairment charges of €300-400m are expected in 2013, compared with €547m in 2012 and €525m in 2011. Impairmentr in Q1,2013 were €99m compared with €195m in Q1,2012 and €87m in Q4,2012.

(5) Retail deposits rose by €0.3bn in Q1,2013 – including from 5,000 new accounts – bringing the overall total of deposits to €2.7bn

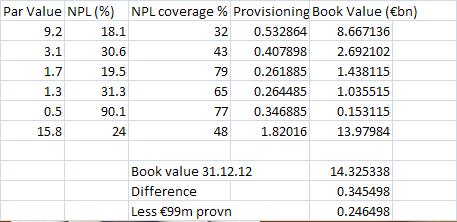

(6) Post-provision loans are €14.0bn down from €14.3bn in 2012 compared to €15.7bn in 2011. [UPDATE 17th May 2013. The KBC presentation didn’t show the post-provision loans, just the par value, the % non-performing, and the % of non-performing taken as a provision. I have worked out the detailed after provision value below which is €13.98bn, which is €345m down from the €14.325. When you deduct the €99m increased provision for losses in Q1,2013, the net reduction in lending is €246m.

The view on here is KBC faces colossal challenges, and with an injection of Belgian blood onto the Irish board this year and after a cumulative €1.055bn bailout from the Belgians, you would wonder how long KBC is to operate here.

Minister Noonan might note that KBC is providing €14bn of net after impairment credit to the Irish economy, but the trend is obvious with deposits growing strongly attracted by high deposit interest rates, loans being reduced and corporate funding from the Belgian parent being reduced. Will a point arrive when KBC cuts its losses.

KBC sucked [UPDATE 17th May 2013] €0.546bn out of the Irish economy in Q1,2013, comprising an increase in deposits of €0.3bn and a net reduction in loans of €0.246bn. That compares with €2.3bn sucked out in 2012. KBC is steadily reducing its parent company exposure to Ireland, thanks to redeeming loans and attracting more deposits. It is a bank to watch closely.

KBC remain in Ireland for one reason only. To try to extract value from the 14bn loan book.

Consider the €14BN Irish loan book as a % of a total group equity of €16.4BN as published today.

See page 69 of their presentation for a view of the country loan books.

https://multimediafiles.kbcgroup.eu/ng/published/KBCCOM/PDF/COM_ECL_pdf_presentation_analysts_1Q_2013.pdf?

If they pulled out of Ireland the likelihood is that they would have to ‘recognize’ an Irish loan book loss of up to 50% of loan book or about 7BN.

Not good for KBC. It would put them in intensive care.

So the strategy is to stay in Ireland, pretend to be a bank and collect Shylock-like every pound of flesh, with the small difference now being that blood drops spilled carry no penalties.

KBC are no different to other major EZ banks. Deutsche bank has equity of 54BN or 2.7% of its total assets.

A good night and a bad breakfast would kill off a lot of EZ banks. That is what lies behind EZ ‘economic’ policy. A debt collectors agenda and an economic vortex.

Cheezus Crust! When are the banks going to give us the truth. If you believe that load of rubbish signed off by some myopic bunch of auditors, there’s this bridge in Brooklyn ……..