Well that day has finally arrived. After 3.5 years and 2,700 blogposts, this is the final NAMA wine lake blogpost. I truly regret that I can’t continue something that has become more than full-time and has stopped me leading anything like a normal life.

There was going to be a much longer farewell blogpost but that is not to be, though I will include the already-drafted section on NAMA itself below*

The 2,700 blogposts will remain online – from emigration to bank-controlled hotels to political pay/perks and centrally of course, NAMA, there are thousands of hours of original research on these pages, some not available elsewhere. Commenting has now been closed, but the body of nearly 20,000 comments will remain. The jagdipsingh2008 email address will be permanently closed on Sunday next and will have the digital equivalent of concrete poured over it, so the thousands of messages received on here in confidence will forever remain confidential. The Twitter feed has now ceased.

To the audience, thank you for visiting and I hope the blog delivered what it said on the tin – to be provocative, engaging and contain real information. To commenters, you have added a wealth of knowledge, opinion, humour and links which has dwarfed the utility of the blog otherwise. To those who contacted the blog in confidence, your information and insight/opinions have extended what was the offering otherwise Thank you all.

Sin a bhfuil.

*“It is flattering to hear NWL being sometimes referred to as to most authoritative source for what is going on at NAMA. It’s also depressing because I know how little is reported on these pages. The most common question asked by the public about NAMA is “how is NAMA doing” and the most authoritative reply I can give you on here is “I don’t know”.

You see, you might think that you can assess NAMA’s performance by reference to its impact on individual properties or loans eg NAMA bought Developer A’s €150m loan for €100m and NAMA was subsequently repaid €150m when it sold the loan or managed the property, that would be an impressive success, but we never know in respect of an individual loan what its par value is, what its NAMA acquisition price is or generally the disposal value. So on an INDIVIDUAL basis, we can’t assess NAMA’s performance. NAMA refuses to provide details on individual sales because of the legislation under which it operates though I have no doubt NAMA itself welcomes the lack of scrutiny which might lead to it being bogged down in the minutiae of constantly defending itself (though it might also reveal instances of poor performance).

So, we look to the OVERALL performance in the financial accounts, but here, the figures are so distorted by (valid) accounting conventions that again, we don’t really know what’s happening. At this point, most cynics say NAMA is taking advantage of the conventions to hide massive losses but you can’t conclusively say that. Two of the main distortions are the accounting policy which stops NAMA recognizing profits on an individual loan until all the loans associated with the relevant developer are disposed of, eg if Developer A has two loans from NAMA, one for €150m which NAMA acquired for €100m and another for €50m which NAMA acquired for €25m. If NAMA disposes of the first loan for €150m, then it has made a profit, but NAMA won’t report that profit until it deals with the second loan, and the second loan might be resolved at a loss of €20m. NAMA does indicate the profits it has not accounted for, but NAMA doesn’t indicate the quality of unresolved loans with the same developers.

The second convention which really distorts NAMA’s overall performance is the way in which financial institutions generally, account for the value of their loans. The estimate on here is that the property underlying NAMA’s loans has dropped by more than €7bn since NAMA acquired the loans, but NAMA has written off less than half that, because accounting conventions allow NAMA to estimate the future cash flow from loans and to pay limited attention to the underlying property, and NAMA is in the view on here, overly optimistic in its future cash flow estimates. So, you can’t rely on the accounts for an OVERALL assessment of NAMA’s performance.

So in response to the question “how is NAMA doing”, the ready response on here is “I don’t know”

Will NAMA make a profit by 2020? Who knows, none of us has a crystal ball. I would have said that if the broader economy stabilizes by the mid 2010s, and grows at a near 3% in 2016-2020, then NAMA could return a modest profit based on how it currently operates. A lot of its ultimate performance however, will depend less on its own actions and more on the general economic environment.

Lastly, NAMA staff – are they any good? NAMA staff are criticized for many things from various quarters: being petty, intimidating and vindictive. And their performance is criticized for being slow, not being commercial enough, dogmatic and inflexible, and unintelligent. These are points of view of course. But, what appears to be universally agreed – even by detractors – is that they are hard-working, honest, accomplished and making progress in what is one of the most high-profile and politically-charged organizations in a country that invented the term “gombeen politics”. NAMA might have been a different beast if it was led by Ryanair’s Michael O’Leary but Michael O’Leary wasn’t available and we lobbed the NAMA baby into the safe hands of Brendan McDonagh – conservative, careful, considerate, risk-averse accountant in the civil service mould. And so far, he has delivered to the expectation of those that know him. The one big criticism on here of NAMA is its failure to at least kick up a stink in 2010 when it became clear that property prices were still tanking, so that the NAMA valuation date could be changed, which would have meant NAMA paying far less for the loans, maybe €5-10bn less, which would mean that NAMA’s performance today was more impressive, though it would have left a further hole in the banks which needed to be filled with a further bailout. Furthermore, NAMA is not an organization to rival the red-in-tooth-and-claw asset management companies, but for a politically inspired agency, it has very impressive staff overall”

Posted in NAMA |

For two of the past 3.5 years on the NAMA wine lake blog, the ingenious talent that is Japlandic has very kindly offered their services with interpreting what have been historic events as well as everyday commentary such as on political pay and perks. Today, Japlandic produced the following image for what was intended to be a review of Minister for Finance, Michael Noonan’s contribution to Irish public life, particularly over the past two years in the current administration. Minister Noonan celebrates his 70th birthday on Tuesday. Unfortunately the full blogpost itself is not to be, but Japlandic has encapsulated its overall assessment and their work shouldn’t be wasted. So, for the last time, graphic below from Japlandic.com, contact here.

Posted in Politics |

Table of the Week

This week, the European statistics agency, Eurostat published the latest GDP data for the EU and selected non-EU countries. Nine of the 27 EU countries are clearly in recession with two successive quarters of negative GDP growth, but as we know on here, Ireland too is in recession because although its change in Q4,2012 was officially logged as 0.0% or -0.0%, it is actually -0.047% which confirms a second quarter of GDP contraction.

Salaries of the Week

This was the week that we learned the last accounts for the Irish Film Classification Office were for 2009 and that subsequent accounts hadn’t been filed “due to an oversight”. We learned this week that the latest accounts filed for Ireland’s woeful Competition Authority were for 2010 and are available here. No word on subsequent years. We learned that the average salary for the 46 staff in the Competition Authority, comprising four board members, 38 staff and four secondments from other Government departments was an impressive €68,600 in 2010. Furthermore, the relatively small operation ran up unspecified – no, not building or travel or printing or advertising – administration costs of €139,000 and IT costs of €104,000. Overall, the operation cost us €4.4m in 2010. Its outputs are less impressive, it certainly deals with notifiable mergers but I cannot see evidence of robustly rejecting a merger, ever. There are a tiny number of prosecutions for competition infringements, and yet, we continue to live in a State where medicines are several times more expensive than in the neighbouring jurisdiction, our lawyers are still the second most expensive in Europe after Moscow, our recession-racked economy still tolerates €500-1,000 per hour payments to professions. And don’t even get me started on consumer goods, from groceries to mobile phones.

Quote of the Week

“It really does make me ashamed of my government when they can get wages in the hundreds of thousands annually, but when one of the most important children’s wards in Ireland, for some of the sickest kids in Ireland, has to rely on charitable donations to buy a bucket of paint and a brush. That is one of the sickest things I have ever come across in my short lifetime here” 16-year old Kerry man Donal Walsh who lost his fight with cancer last weekend – in his own words he wrote about dealing with cancer, they’re worth a read here and here.

Rubbish of the Week

A month ago, amid widespread illegal dumping in the Gardiner Street area of Dublin, Dublin City Council was threatening not to collect rubbish from certain areas of the city and let the residents resolve the problem of illegal dumping themselves; how, wasn’t clear but it had hints of a call for vigilantism but in the end, DCC abandoned that hare-brained scheme but have now introduced another – over a week ago, they confirmed they were writing to local authority tenants demanding proof that they had paid for a waste disposal provider. And it seems DCC is even proposing to extend this new scheme to allow its officials knock on anyone’s door to demand proof of having engaged a provider.

Curse of Dragons Den of the Week

The “curse of Hello” where full colour splashes of celebrity lives in the pages of Hello magazine, only to be soon followed by banana skins, revelations of peccadillos and tragedy, seems to have spread to the Dragons Den, the Japanese TV format created which was picked up by the BBC and latterly by RTE. In Ireland, we have seen Dragons Bill Cullen’s motor dealership and hotel operation fall from grace, and more recently Niall O’Farrell’s chain of formal wear and suit hire shops fall victim to the ongoing recession. In the UK this week, the Daily Mail suggested that one of the stars of the UK version of the show, Duncan Bannatyne was facing money troubles, though the scrappy Scotsman was quick to tweet that the Daily Mail story was untrue.

Table of the Week

This week, the NTMA produced its monthly “Ireland has turned the corner” presentation to investors with its laughable spin on an economy still in recession, with 14% unemployment, with retail sales declining (fast), with commercial property rents and capital values declining, with residential property declining, the NTMA still manages to appear positive. Its openness proxy is a good one – this adds together exports (X) plus imports (M) and divides the sum by GDP. In Ireland’s case, we are amazing compared to the other PIIGS, but this ignores the massive in/out flows from multinationals which is a unique feature of the Irish FDI-focussed economy. Anyway, good to know residential property rose for the first time since 2007…..

Old Media swan song of the Week

“Sarah McInerney of The Sunday Times acknowledged that the online version of that newspaper’s Irish edition which she said was known within the company as the “regional edition”, was “not doing well”.” So reported the Irish Times this week

We also had UTV’s management statement for Q1,2013 which noted that its commercial radio operations in Ireland (north and south) were down 8% in Q1,2013 compared to a year previously. That’s a worrying decline for a company that is well regarded commercially but more worrying was the statement “We believe that we continue to outperform the market” which doesn’t bode well for competitors here, particularly RTE and Communicorp (Newstalk and Talk amongst others) and Landmark Enterpises (the Crosbie vehicle that has taken on the operation of local radio interests previously managed by TCH).

We also had Johnston Press’s management statement for Q1,2013 – you might ask where are the statements for Irish-owned companies but apart from IN&M indicating revenues were down 10% this year on last, we haven’t heard a mig from our own. Johnston Press publishes 12 local titles in Ireland – Donegal Democrat, Donegal People’s Press, Dundalk Democrat, Leinster Leader, Leinster Express, Leitrim Observer, Longford Leader, Kilkenny People, Limerick Leader, The Nationalist and Munster Advertiser, Tipperary Star and The Echo in Tallaght. Although total revenues were down 11.4% in Q1,2013 from a year previously, it seems the decline is concentrated on advertising and that circulation revenue had held up.

Resemblance of the Week

Colourful Independent TD for Roscommon, Luke “Ming” Flanagan turned up at the Dail this week, a-la-Paris Hilton, with a tiny dog in tow. Julie, which could be a Scottish Terrier but could be some lovable Roscommon-Leitrim mongrel. Perhaps one of these days, the old media might run a feature of politicians and their dogs to judge if owners indeed chose dogs in their own reflection.

Parliamentary insult of the Week

“In truth I have to say that I am fed up to the back teeth with the foot dragging, the whinging, the stalling; sometimes, you might even say the attempt to politically posture on critical issues such as this; the begrudging, the bellyaching that you hear, the conditioning before statements can go out from colleagues. And I’m depressed listening to a tribe of Jeremiahs that infest the political process and whose first thought is to attack any genuine attempt that is made for positive proposals. And those people of course have nothing to contribute themselves. And I also have to say that I get glum at the whited sepulchers who pontificate to us about a shared society and talk to us about harmony and consensus politics and yet, unless they are taking the lead themselves and are taking everything they want, they strain and stretch every sinew to abstain and obstruct what is going on. And quite honestly Mr Speaker, I think we have reached the stage that if we wait for the last person to board the train, the train will never leave the station“ Peter Robinson, First Minister of Northern Ireland, in the Stormont Assembly responding to criticism of the joint Sinn Fein/DUP “Together: Building a United Community”

Let’s hope Peter’s grasp of the political challenges facing Northern Ireland is better than his grasp of the Good Book. The prophet Jeremiah may well have forecast doom-and-gloom but as it turned out, his predictions were accurate. And a day or two later, the TUV picked up on this when they issued a statement

“Yesterday the co-First Minister branded his critics in the Assembly “a tribe of Jeremiahs”. The image struck me as an exceptionally odd form of insult, particularly as the warnings proffered by Jeremiah proved to be accurate. Given the traffic chaos which is developing at the Maze it is obvious that the warnings of some Jeremiahs have been well founded.”

Tax Home Truth of the Week

“The art of taxation consists in so plucking the goose as to obtain the largest amount of feathers with the least possible amount of hissing” Jean-Baptiste Colbert, finance minister under Louis XIV in 17th century

Okay, it’s not new but the general absence of hissing over the property tax – yes, there have been a few marches, a handful of occupations but the indications from the Revenue Commissioners is that the tax has been accepted far more widely than its predecessor, the household charge. This time around, the Government has firmly passed responsibility for the tax to the still-generally-feared Revenue Commissioners, it has a 50% discount in place for 2013 and despite it being a deeply unfair tax in many respects, it seems as if it is on track to be accepted by a considerable majority by the filing deadline – 28th May 2013.

Act of Transparency of the Week

In Uganda, a country with a land area three times that of Ireland, and a country to which we provide foreign aid, this week, they achieved a fully computerized Land Registry showing who owns what. Amazing. In Ireland, we haven’t quite registered all property yet, and there is a sizable amount, particularly in south county Dublin, apparently, that has yet to make it online. So, you just have to wander up to the dusty Public Records Office on Constitution Hill in Dublin and pay your €15 for a photocopy.

Whitewash of the Week

The vehement disdain towards the “anonymous author” that blew the whistle on Garda malpractice in quashing traffic penalty points, was not well disguised. Nor was the anonymous author whom we’ve all known for some time was John Wilson. The report itself is here and there is a lengthy additional report on what the Garda practices are. Heads are still being scratched at how seven separate notices being quashed for the same family didn’t rise to the level of corruption. But mostly we wanted to know why the Gardai were investigating themselves when we have a perfectly good Garda Ombudsman set up for such investigations. Three Gardai face disciplinary action, the report will now be examined by the Oireachtas justice committee but the Garda Commissioner and Minister for Justice Alan Shatter are desperate to draw a line under the whole affair and calls by Transparency International for better protection of whistleblowers seem to have fallen on (the) deaf ears in Officialdom.

Response to debt demand of the Week

And finally, Clare Dooley whose Twitter profile says she assists people suffering in the economic downturn provides a novel approach to demand letters from the banks.

Posted in Banks, Developers, House Price Database, Irish economy, Irish Property, Politics | 8 Comments »

“Additional financing to existing borrowers: The merged entity may not provide additional financing which is not contractually committed at the time of the approval of the joint restructuring plan (in line with the commitment referred to in point (ii)).” European Commission decision on 29th June 2011 on the run-down of Anglo and Irish Nationwide

There is no development at the High Court in respect of Paddy McKillen’s (and Denis O’Brien’s) application for an injunction against the Sunday Times and its reporter, Mark Tighe – there are no new filings and we are now well past the six weeks which was intimated would be the full hearing date when the partial injunction was obtained by Paddy at the end of March 2013. The Sunday Times has in recent weeks provided some additional reporting of the general matter subject to the injunction, and it seems one of the details is that Paddy sought what was described by the Sunday Times as an emergency loan approval last October 2012 to pay some of the €25m estimated legal fees which Paddy was ordered to pay when he lost his High Court challenge against the Barclay brothers.

The Sunday Times reported that Paddy sought approval for a [CORRECTED] GBP 5.0m (€6) – the Sunday Times refers to a GBP 5m (€5.9m) loan in one part of the story and a [CORRECTED] GBP 5.9m legal fees bill elsewhere [CORRECTION: the loan sought was €5.9m but the legal fees bill that was falling due to be paid was GBP 5.9m, in other words, Paddy was seeking a loan for just part of the legal fees bill] – loan to pay the legal fees that he was required to pay on account, pending the appeal of the decision, the outcome of which we’re still eagerly awaiting. The Sunday Times reported that the board of IBRC – remember Mike Aynsley was then CEO and Alan Dukes was chairman – approved the loan. According to Paddy, he eventually decided to fund the [CORRECTED] GBP 5.0m element of the GBP 5.9m legal fees from elsewhere.

All well and good.

But it seems that there is now an issue regarding the decision by the IBRC board to approve the loan to Paddy, even if Paddy didn’t eventually draw it down. IBRC operates under rules imposed on it in June 2011 when the European Commission approved an orderly wind-down of IBRC. One of the terms of the decision by the EU is that

“Additional financing to existing borrowers: The merged entity may not provide additional financing which is not contractually committed at the time of the approval of the joint restructuring plan (in line with the commitment referred to in point (ii)).”

Point (ii) states

“Ban to develop new activities and to enter new markets: The merged entity will not develop any new activities and will not enter new markets, that is to say that the merged entity will not carry out any activities other than those that are consistent with managing the work-out of the Anglo and INBS legacy loan book (including loan sales, where appropriate, to maximise recovery values). In particular, the merged entity will maintain and use its banking licence only as long as necessary for the work-out of the loan portfolios and will not use it to develop new activities. […].”

In the Dail this week, the Sinn Fein finance spokesperson Pearse Doherty asked Minister for Finance Michael Noonan if IBRC breached these rules in approving a €5m (sic) additional loan to Paddy. Minister Noonan, whilst citing the European Commission decision overall, says that he is “not aware of any breaches by IBRC of the Commitments contained in that decision.”

The parliamentary question and response is here.

Deputy Pearse Doherty: asked the Minister for Finance his views on whether the Irish Bank Resolution Corporation breached the terms of its Commitments Letter to the European Commission by issuing a further €5 million loan to a person (details supplied) in 2012 to pay legal costs, when their debt with IBRC amounted to approximately €900 million in personal and corporate accounts at the time. [23153/13]

Minister for Finance, Michael Noonan: I am advised by the Special Liquidators that they are not in a position to comment on individual cases. The information requested is confidential and it would not be appropriate for the Special Liquidators to release such information.The terms of the European Commission Commitments letter are contained in the Commission Decision of 29.06.2011 and published at –

Click to access 235764_1251125_112_6.pdf

I am not aware of any breaches by IBRC of the Commitments contained in that decision.

Posted in Banks, Developers, Hotels, Non-Irish property, Politics | 1 Comment »

According to the US court service, PACER, there have been 52 filings so far in Sean Dunne’s bankruptcy in Connecticut – the betting is that by the time this bankruptcy is resolved there will be a multiple of 52. Yesterday’s filing is by Sean’s wife, who is now styled “Gayle Killilea Dunne”, not Gayle Killilea and not Gayle Dunne. Gayle’s request is to be recognized as a notice party in the bankruptcy under Rule 2002 and Rule 9010 of the Rules of Bankruptcy Procedure. Rule 2002 applies to “Creditors, Equity Security Holders, Administrators in Foreign Proceedings, Persons Against Whom Provisional Relief is Sought in Ancillary and Other Cross-Border Cases” and requires the applicant to be treated as notice party to the bankruptcy proceedings. Rule 9010 appears to simply allow the notice party to be represented by a lawyer.

Gayle has engaged Connecticut law firm Reid and Reige and her specific lawyer is Eric Henzy, described on his bio at the firm as practicing in “business bankruptcies and workouts and business and commercial litigation”.

It should be stressed, if it isn’t apparent already, that it is only Sean Dunne who has filed for bankruptcy; by all appearances, Gayle’s finances appear to be hale and hearty and she is financially separate from her husband. It should also be stressed that there is no separation or divorce proceedings chez Dunne, and Gayle’s Irish solicitors, Clerkin Lynch have made that clear this week, though that story appears no longer to be online. [CORRECTION: the Sunday Times story is accessible here]

The application is here.

Posted in Developers, Hotels, NAMA, Non-Irish property | 1 Comment »

Welcome to another depressingly sparse and qualified blogpost on NAMA’s latest foray in Dublin’s High Court.

Yesterday NAMA, or specifically, National Asset Loan Management Limited represented by top-tier law firm, McCann Fitzgerald launched two separate actions in Dublin’s High Court – case references 2013/1590S and 2013/1591 S. The defendant in the first case is an individual named “Maria Byrne”. The defendant in the second case is an individual named “Graham Byrne”. As is usual in recently-filed cases, there is no solicitor on record for the respondents.

Who is Maria Byrne and who is Graham Byrne? Impossible to say, because neither NAMA nor the Court Service will confirm their identities, with associated companies or specific or general addresses. Are they related? Other than sharing a surname, “Byrne”, impossible to say, the could be husband and wife, but they could be totally unrelated, naturally or legally. Are they even Irish? Again, impossible to say, they might be Nigerian for all we know.

And why is NAMA is suing them, and what is NAMA seeking from the action? Again, impossible to know as NAMA won’t say and the Court Service won’t provide the application. In the past, NAMA has had lodged very serious applications seeking judgments of hundreds of millions, on the other hand, it has made so-called “protective applications” to reserve its position to sue on a matter for example, when the Statute of Limitations would bar future legal action unless a protective application was made.

So, there you go. NAMA’s 18th and 19th applications in Dublin’s High Court this year. NAMA has been on the receiving end of 15 applications, including 12 relating to a development in Portugal where buyers want their deposits back, one where Paddy McKillen is suing (again) for alleged breach of privacy and confidentiality. And finally please no speculation on who the Byrnes are, you can assume that the names have been Googled and run through company director records and media reporting.

Posted in NAMA | 1 Comment »

This afternoon in Dublin’s High Court, Mr Justice Iarflaith O’Neill ruled in favour of the colourful Johnny Ronan’s landlord company in a case against the tenant, the Irish Medical Council. Johnny’s company, Tanat Limited, co-owned with Kildare developer Peter Conlan had claimed that a lease on a property, Kingram House off Fitzwilliam Square pre-dated February 2010 when Upward Only Rent Review clauses were outlawed. Although the lease was technically entered into after February 2010, the judge today ruled that a series of exchanges in 2008 were sufficient to establish the existence of a lease then.

So great news for Johnny who will see the rent maintained at €820,000 even though the evidence shows the current market rent for Kingram House today would be €374,100.

The judgment from today is not yet online.

Elsewhere the Court Service indicates that there has not yet been any appeal by Johnny’s company Ickendel against a High Court ruling which saw Bewleys Oriental Cafe win the right to a current market rent rather than the 2007 rent which had been imposed on it. NAMA might have been called on to fund the appeal, and it might be the Agency decides to let this litigation pass. Last year. Johnny lost control over many of his prized assets when NAMA had receivers appointed to Treasury Holdings companies and subsequent attempts by Johnny to have the receivership overturned were unsuccessful. And more recently the Treasury Opera CMBS is ending up in the hands of investors who bought underlying loan rights.

Posted in Developers, Irish economy, Irish population, Irish Property, NAMA, Politics | 2 Comments »

“These are challenging times for the whole banking sector in Ireland, not just for the domestic banks. KBC Ireland is an important provider of credit to the Irish housing market and as the Deputy rightly points out the Bank has extended some €14 billion of credit to the Irish economy.” Minister for Finance Michael Noonan on 23rd April, 2013

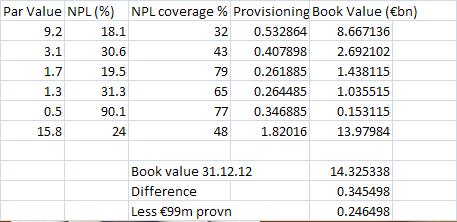

This morning KBC Ireland, one of the few non state-owned retail banks operating in Ireland, released its management statement for the first three months of 2013. There is a separate presentation to analysts here and Ireland is detailed on pages 62-64. Here’s what we learn:

(1) Loss after tax and impairment provision of €77m in Q1,2013 compared with €148m in Q1,2012

(2) Mortgages in arrears have risen from 17.5% of the principal residential loanbook at the end of 2012 to 18.1% today.

(3) Mortgages in arrears have risen from 29.2% of the buy to let loanbook at the end of 2012 to 30.6% today.

(4) Impairment charges of €300-400m are expected in 2013, compared with €547m in 2012 and €525m in 2011. Impairmentr in Q1,2013 were €99m compared with €195m in Q1,2012 and €87m in Q4,2012.

(5) Retail deposits rose by €0.3bn in Q1,2013 – including from 5,000 new accounts – bringing the overall total of deposits to €2.7bn

(6) Post-provision loans are €14.0bn down from €14.3bn in 2012 compared to €15.7bn in 2011. [UPDATE 17th May 2013. The KBC presentation didn’t show the post-provision loans, just the par value, the % non-performing, and the % of non-performing taken as a provision. I have worked out the detailed after provision value below which is €13.98bn, which is €345m down from the €14.325. When you deduct the €99m increased provision for losses in Q1,2013, the net reduction in lending is €246m.

The view on here is KBC faces colossal challenges, and with an injection of Belgian blood onto the Irish board this year and after a cumulative €1.055bn bailout from the Belgians, you would wonder how long KBC is to operate here.

Minister Noonan might note that KBC is providing €14bn of net after impairment credit to the Irish economy, but the trend is obvious with deposits growing strongly attracted by high deposit interest rates, loans being reduced and corporate funding from the Belgian parent being reduced. Will a point arrive when KBC cuts its losses.

KBC sucked [UPDATE 17th May 2013] €0.546bn out of the Irish economy in Q1,2013, comprising an increase in deposits of €0.3bn and a net reduction in loans of €0.246bn. That compares with €2.3bn sucked out in 2012. KBC is steadily reducing its parent company exposure to Ireland, thanks to redeeming loans and attracting more deposits. It is a bank to watch closely.

Posted in Banks, Irish economy, Politics | 2 Comments »

If you were asked to name the NAMA board, you’d probably struggle beyond Brendan McDonagh the CEO, Frank Daly the chairman and John Mulcahy the head of asset management. But there’s a former IMF mission chief there also, Steven Seeling, not to mention a former county manager William Soffe, former KPMGer Eilish Finan and the board’s most recent appointment Oliver Elingham who got the call from Minister for Finance Michael Noonan last month.

And then there is Brian McEnery, an accountant who is a partner in accountants and receivers Horwath Barstow Charleton in Limerick. Brian was appointed in December 2009 , a full 13 months before General Election 2011 where Brian was director of elections for Limerick-man Michael Noonan who is now of course the most important minister in this administration. Brian’s is chair of NAMA’s audit committee and his term on the NAMA board is set to expire in December 2013.

Last week, Minister for Health James Reilly announced that Brian has been appointed chairman of the Health Information and Quality Authority, HIQA – the organization that monitors standards of health care.

Posted in Irish economy, NAMA, Politics | 3 Comments »