| General | |||||

| The reserved judgment in the Paddy McKillen | |||||

| appeal hearing in London is due any day now | |||||

| IBF mortgage drawdowns for Q1,2013 due | |||||

| Central Bank arrears/repossessions Q1,2013 due | |||||

| Monday 13th May 2013 | |||||

| Eurogroup meeting Brussels | |||||

| Tuesday 14th May 2013 | |||||

| EcoFin meeting Brussels | |||||

| Wednesday 15th May 2013 | |||||

| Allsop Space auction in Shelbourne Hotel, Dublin | |||||

| IPD UK commercial property indices April 2013 | |||||

| (CSO) Agricultural Price Indices March 2013 | |||||

| (CSO) Industrial Disputes Quarter 1 2013 | |||||

| Educn & Soc Protection Oireachtas comm: rent allowance | |||||

| Thursday 16th May 2013 | |||||

| (CSO) Goods Exports and Imports March 2013 | |||||

| KBC Ireland Q1,2013 results | |||||

| ECB Governing Council meeting | |||||

| Good Friday Agreemt Oireachtas comm: Narrow Water Bridge | |||||

| Friday 17th May 2013 | |||||

| (CSO) Trade Statistics February 2013 | |||||

| Saturday/Sunday | |||||

Archive for the ‘Greece’ Category

Week Ahead 13th May 2013 – 19th May 2013

Posted in Banks, Developers, Greece, Hotels, Irish economy, Irish Property, Non-Irish property, Politics on May 13, 2013| 3 Comments »

The departing Matthew Elderfield

Posted in Banks, Greece, IMF, Irish economy, Politics on May 3, 2013| 6 Comments »

I must admit to never really taking to Matthew Elderfield, the man who currently holds the twin titles, deputy governor of the Central Bank of Ireland and Financial Regulator. He came in here from Bermuda in January 2010 when our banking sector was in the eye of the storm and three years later, the sector is much changed but still in crisis. Known for his perma-scowl, bowingly captured in the old media, Ireland was another expat posting where he was paid a barrowload of money, and now, three years into a five year contract, he is “returning home” to the UK where he is set to take up a directorship – confirmed this week as director of conduct and governance – in Lloyds in October 2013

Whilst here, he oversaw two lightweight stress tests of the banks, before we got serious under the whip-hand of the IMF and ECB and did it properly at the start of 2011 – by “properly” I mean the results were given more credence by the audience of markets and government though at €30m-odd, they were certainly more expensive than what went before. Matthew was close to the helm when the €30bn of promissory notes were created. Retail banking competition has contracted with banks deleveraging and rationing lending, there are some horror stories about tracker mortgage holders being strong-armed onto variable rate mortgages, variable rates are rising when the trajectory at the ECB is flat to declining. There has been no enquiry into swap mis-selling even though there is a steady stream of actions in our courts. The credit union sector has been bailed out and we still have very expensive receivers acting in the Newbridge branch. Nearly two years after NAMA’s tranches 3/4 were acquired with a par value of €19.2m, the due diligence by Matthew has still not been completed.

On the other hand, the word from those close to the Bank, is Matthew has changed the culture which is now more engaged and accountable than it was under the previous string of Government appointees – some might even call Matthew’s predecessors, “lackluster insiders”. It is thanks to Matthew we have the quarterly data on mortgage arrears, so at least we generally know the scale of the problem, even if solutions have remained elusive. And, although it was controversial and a sizable number vehemently disagree with the decision, the view on here is that Matthew showed courage, a sense of probity and a commercial instinct when he acted against Quinn Insurance.

As for his successor, the odds-on favorite is his underling Fiona Muldoon who was confirmed this week to have the poison-chalice responsibility for the mortgage resolution targets – the view on here is that 25,000 sustainable mortgage solutions by the end of June 2013, two months hence, is fanciful; sincerely though, good luck to her.

When Matthew’s resignation was announced by the Governor of the Bank, Patrick Honohan, it was stated that Matthew was waiving a €100,000 bonus which was magnanimous of him. Questioning in the Dail however raises doubt as to whether the bonus was actually awarded. Minister Noonan was asked “the date on which the bonus was awarded; the amount of the bonus awarded; the maximum bonus to which Mr Elderfield was entitled; and if he will outline the objectives met by Mr Elderfield which gave rise to the award of the bonus.” [ENDS] The relevant response from Minister Noonan merely states “Mr Elderfield agreed to defer the payment of any possible performance related bonus, which was due in January 2013, as part of his terms and conditions of employment agreed, until the end of his employment with the Central Bank. Mr Elderfield has subsequently advised the Commission of the Central Bank that he has waived his €100,000 bonus entitlement at the end of his contract of employment. “[ENDS] The Central Bank was asked for comment and if it might clarify the position, but there was no response at time of writing.

There are now, also, questions about rules within the Central Bank to stop employees departing for the private sector where their privileged knowledge might be deployed to the benefit of their new employer. Matthew’s new employer, Lloyds still has a huge exposure to Ireland with its legacy Bank of Scotland (Ireland) loans, some of which are now managed on behalf of BoSI by Certus. Matthew does not have a commercial function at Lloyds but as a director, even of conduct and governance, he is in a position to potentially be very helpful indeed to Lloyds, though there is no suggestion here that Matthew would ever use his three years of privileged knowledge to Lloyds benefit. But what is to stop him? Minister Noonan’s response will not fill you with confidence; the Bank might move resigning employees away from duties which might bring it into conflict with a new private sector employer but there seems to be obstacle, like a confidentiality agreement or Standards in Public Office which might hinder a departing employee to spill the beans to a new employer.Worrying.

Information in the above is partly derived from these parliamentary questions from the Sinn Fein and Fianna Fail finance spokespersons:

(1) Deputy Pearse Doherty: To ask the Minister for Finance if he will outline the rationale for providing for a €100,000 termination bonus for the Financial Regulator who was appointed in January 2010 and who has recently tendered his resignation to the Central Bank of Ireland.

Deputy Pearse Doherty: To ask the Minister for Finance if he will outline the duties to be performed by the Financial Regulator during his remaining six month’s employment at the Central Bank of Ireland; and if he will provide the expected salary and allowances to be paid to the Financial Regulator during this period.

Minister for Finance, Michael Noonan: I propose to take questions 208 and 210 together.

The terms of the contract agreed by the Central Bank with the Deputy Governor Financial Regulation provided for a performance related payment of €100,000 payable on review of performance at the end of the third year of the contract.

When Mr. Elderfield’s contract was agreed in November 2009 the bonus was part of an agreed remuneration package which involved a 50% paycut from his salary in Bermuda. Mr. Elderfield subsequently took a 15% cut in his Central Bank salary.

Mr Elderfield agreed to defer the payment of any possible performance related bonus, which was due in January 2013, as part of his terms and conditions of employment agreed, until the end of his employment with the Bank.

Mr Elderfield has subsequently advised the Commission of the Central Bank that he has waived his €100,000 bonus entitlement at the end of his contract of employment.

The Deputy Governor of Financial Regulation will continue performing the duties as outlined in the contract of employment. However, where a conflict of interest could be perceived in supervisory and other issues he will step away with immediate effect from involvement in these issues. Remuneration for the period is as per the terms in the contract of employment.

(2) Deputy Pearse Doherty: To ask the Minister for Finance further to Parliamentary Question No. 272 on 29 January 2013, the reason it has taken nearly two years for the Financial Regulator to validate the process of the transfer of tranches 3 and 4 to the National Assets Management Agency where the par value of the loans was €19.2 billion and the NAMA acquisition was completed in June 2011..

Minister for Finance, Michael Noonan: While I cannot comment on the work undertaken by the Financial Regulator, as the Deputy will be aware the validation process is complex and the work is essential to ensure that the European Commission guidelines ensuring full transparency in relation to state aid are complied with.

I am advised that the process to have the final tranches validated is in its final phase and will be concluded shortly; at that point my Department will be in a position to apply to the European Commission for its full approval.

(3) Deputy Pearse Doherty: To ask the Minister for Finance further to Parliamentary Questions Nos. 208 and 210 of 23 April 2013, if he will confirm if a bonus had in fact been awarded to Mr Mathew Elderfield; if so, the date on which the bonus was awarded; the amount of the bonus awarded; the maximum bonus to which Mr Elderfield was entitled; and if he will outline the objectives met by Mr Elderfield which gave rise to the award of the bonus.

Minister for Finance, Michael Noonan: I am informed by the Central Bank that the terms of the contract agreed with the Deputy Governor Financial Regulation provided for a performance related payment of €100,000 payable on review of performance at the end of the third year of the contract.

When Mr. Elderfield’s contract was agreed in November 2009, the bonus was part of an agreed remuneration package which involved a 50% cut from his salary in Bermuda. Mr. Elderfield subsequently took a 15% cut in his Central Bank salary.

Mr Elderfield agreed to defer the payment of any possible performance related bonus, which was due in January 2013, as part of his terms and conditions of employment agreed, until the end of his employment with the Central Bank. Mr Elderfield has subsequently advised the Commission of the Central Bank that he has waived his €100,000 bonus entitlement at the end of his contract of employment.

(4) Deputy Michael McGrath: To ask the Minister for Finance his views on whether the rules governing employees who leave the Central Bank to take up employment in financial institutions regulated by the bank are adequate to protect the public interest; and if he will make a statement on the matter. [19695/13]

Minister for Finance, Michael Noonan: I am informed that the Central Bank has relevant policies and procedures in place to deal with this potential matter and the Bank believes that its current policies and procedures are appropriate. Specifically, this potential issue is taken into account when drafting new contracts for certain roles or reassigning staff to other duties if a potential for conflict arises.

The Central Bank Code of Ethics requires that in the event of an employee intending to leave the employment of the Central Bank to take up alternative employment, self-employment or business, there is an obligation to provide early notification to line management when a conflict of interest exists, or perceived to exist, between those duties held in the Central Bank and those to be undertaken with the new employer, self-employment or business. In such circumstances, the Central Bank may assign alternative tasks to the individual while their notice period is being served. The notice period may be lengthened in excess of the contractual or statutory notice period, by mutual agreement, where it is considered to be in the best interests of the Central Bank and the employee.

(5) Deputy Pearse Doherty: To ask the Minister for Finance the constraints that apply to employees of the Central Bank of Ireland in the context of resigning and moving to a private sector organisation where confidential or privileged information acquired at the Central Bank of Ireland may be deployed to the benefit of that private sector organisation.

Minister for Finance, Michael Noonan: I am informed by the Central Bank that it has relevant policies and procedures in place to deal with this potential matter and that its current policies and procedures are appropriate. Specifically, this potential issue is taken into account when drafting new contracts for certain roles or reassigning staff to other duties if a potential for conflict arises.

The Central Bank Code of Ethics requires that in the event of an employee intending to leave the employment of the Central Bank to take up alternative employment, self-employment or business, they are obliged to provide early notification to line management when a conflict of interest exists, or might be perceived to exist, between those duties held in the Central Bank and those to be undertaken with the new employer, self-employment or business. In such circumstances, the Central Bank may assign alternative tasks to the individual while their notice period is being served. The notice period may be lengthened in excess of the contractual or statutory notice period, by mutual agreement, where it is felt that this is in the best interests of the Central Bank and the employee.

Revealed! The league table of our overseas diplomatic missions, analysed by country.

Posted in Greece, Irish economy, Politics on April 28, 2013| 5 Comments »

I say “overseas”, but in 2012 we managed to spend €648,614 on a so-called “secretariat” in Belfast and €537,962 in the exotic city of ….Armagh! This week, the Tanaiste and Minister for Foreign Affairs provided details of the €52m cost of running our diplomatic missions across the globe in 2011 and 2012. The results are intriguing, with us spending more in each of Mozambique, Zambia and Uganda than we did in Germany. We spent more in Vietnam than we did in India. And we spent more in Lesotho – small landlocked impoverished mountainous expanse in southern Africa – than we did in Brazil or Mexico. We spent more in Iran than we did in Latvia. We spent more in Sierra Leone than we did in Cyprus. And 2012 saw the final costs coming in for Vatican City, with that mission controversially closed.

There are a few countries in which we don’t have representation which look like odd omissions – New Zealand, Venezuela, Chile, Jordan, Bahrain, Peru, Colombia, Libya, Pakistan, former Yugoslavian states except for Slovenia, Caribbean countries generally, former USSR countries except for Russia, central America except for Mexico and all of the smaller Pacific islands.

It should be stressed that the figures EXCLUDE two major expense headings, the cost of diplomats sent from Ireland and the capital cost of buildings and we know that there have been some rebuilding works that have attracted criticism in the past. Hopefully these omissions will be rectified in the near future so that we can get a total picture of how we spend our money on diplomatic missions.

You can see the PQ which revealed the informationhere where there is a split by city and expense heading.

UPDATE: 7th May, 2013. An Tanaiste and Minister for Foreign Affairs Eamon Gilmore has now confirmed the salaries and allowances paid to Irish staff in 2011 and 2012 together with the capital expenditure on diplomatic Missions. In 2012, €20,367,563 was paid in salaries and €8,709,948 in allowances and €878,604 in capital expenditure.

Of the Week…

Posted in Banks, Greece, IMF, Irish economy, NAMA, Northern Ireland, Politics on April 27, 2013| 2 Comments »

Welcome Back of the Week

If you support transparency in public life in Ireland, you will be delighted to hear that KildareStreet.com is back this week. Hallelujah! For those of your unfamiliar with KildareStreet.com, it maintains records of Oireachtas proceedings, including parliamentary questions. “Why do we need such a record from third parties?”, I hear you ask, “after all, we have the Oireachtas.ie website which is supposed to do that”. As a heavy-user of the Oireachtas.ie website, I can tell you that it is replete with errors, missing tables, missing answers and if you link to a parliamentary question, chances are they’ll change the link address. Also the Oireachtas website is not Google seachable. KilareStreet.com went offline last September 2012 after the Oireachtas introduced a format, but thank God Almighty, it is back this week – welcome back old friend! And here are a few examples of the Oireachtas record keeping that we can wave goodbye to with KildareStreet.com’s return. If you don’t know what I’m talking about, see if you can spot the mistakes on the Oireachtas records below:

Farewell of the Week

Public Interest directors Margaret Hayes and Ray MacSharry are resigning their roles as public interest directors at Permanent TSB. They announced the resignations at the end of March 2013 and they will not seek re-election at the PTSB AGM on 22nd May 2013. Just before Christmas 2012, the hapless Margaret and Ray schlepped up at the Oireachtas finance committee where they were abused for a couple of hours for failings at the bank. At the time, the role of public interest directors was coming under the spotlight and it seems that the 75-year old Ray and the former civil servant Margaret have had enough. But what will the resignation of these two business and public service titans mean for PTSB?

In the Dail this week, the Government provided a considered assessment of the impact of the two resignations.

Deputy Pearse Doherty: To ask the Minister for Finance if he will provide an assessment of the risk to the financial health and profitability of Permanent TSB as well as to the public interest, from the announced resignation of persons (Mr Ray MacSharry and Ms Margaret Hayes) from the board of PTSB in May 2013; and if he will make a statement on the matter.

Minister for Finance, Michael Noonan: As the Deputy will be aware it is a matter for the Chairman of Permanent TSB to ensure that the board of directors is of sufficient size and has an appropriate mix of expertise to comply with governance, company law and regulatory requirements. I have been informed that the current board complies with all relevant requirements but is subject to on-going review and renewal as required. As the Deputy will be aware the directors have fiduciary obligations to the company and have obligations under Section 48 of the Credit Institutions (Stabilisation) Act.

Video of the Week

“In some weird way, the more we fuck things up, the better off we are, I think we’re only eight or nine shit decisions away from freedom”

I often wonder what our Nobel laureate poet Seamus Heaney has been doing for the last five years, when the economy has imploded, emigration has returned with a vengeance and the country is suffering agony – surely a poet might bother to chronicle such seismic national events, pick a few bon mots and maybe even get some of them to rhyme. Our creativity hasn’t been much in evidence on TV or film either – surely there’s a drama to be made in the style of Conspiracy to set out what happened on the Night of the Bank Guarantee. Comedian Tommy Tiernan partly makes up for it and lifts the team this week with these observations on our crisis.

Quango of the Week

The report and accounts for the Irish Film Board for 2011 were published this week. This is an agency into which we shovelled €18.4m in 2011, comprising €16m earmarked for artistic investment and €2.4m for running the agency. It employs 14 people in Ireland plus a CEO and their total salaries are shown as €904,007 or an average of €60,267 excluding pension contributions and given the CEO gets €95,000 it would seem the salaries are very good indeed. The IFB seemingly employs two further people in Los Angeles. In Ireland, it costs €276,015 to house the 14 staff apparently, and the quango has a range of interesting expenses including a €14,000 subscription to employers’ organization IBEC. Best of all though were the loans to board members, totaling over €2m in 2011, see below. Fine Gael stalwart and RTE sports commentator, Bill Herlihy has just been appointed chairman of the IFB. Dontcha just love this country!

Non-event of the Week

NAMA, the biggest state agency by a country mile, reported its unaudited accounts for the year. Here is an agency which generated €1.4bn in revenue, disposed of €2.8bn of loan and property assets, advanced €1bn to developers and is currently sitting on €3bn of cash. It generated a profit of €300m before tax. For an Agency that was created from scratch three years ago and which employs 250 today, the results are stonkingly impressive. Yes, it acquired €74bn of loans for just €32bn, but commercial property prices in Ireland have declined 27% since and residential property is down 32% and the economy is at best bumping along the bottom with banks not lending. All in all, the NAMA staff deserve a pat on the back, when you consider what a disaster the whole project could have been.

The results didn’t garner many column inches. The Irish Times managed to get its reporting badly wrong by claiming that NAMA had already obtained judgments against the six parties it sued in the last quarter of 2012. Some of the cases remain outstanding and I think that ex-BDO, ex-Property Industry Ireland Ronan King will be interested to know the Irish Times says that NAMA has obtained a €559,700 against him (it hasn’t, NAMA has just applied for a judgment).

Old media business reform of the Week

Yesterday, we finally saw the 2012 financial results for Independent News and Media, in Ireland publishers of the Irish Independent, Sunday Independent, Herald, Sunday World, Belfast Telegraph, Sunday Life, Irish Daily Star and a number of provincial newspapers. The group has apparently agreed a deal with banks and its pension fund which should see the group rationalized and placed on a secure financial footing. Alas, there is still some cost-cutting to go, and 10% of its 1,000 staff face the chop in the coming year. Rival newspaper publisher Johnston Press, which publishes some Irish provincial titles, this week demonstrated an impressive obsession with cost control when it closed a premises in Scotland and relocated a journalist to….. a local library! There’s more – Johnston Press said its reporters would be “out in the community more than ever”. How long before the occupants of IN&M HQ on Talbot Street will be working from the Dublin City Library in the Ilac Centre and IN&M’s Lucy Gaffney telling them the move will improve editorial standards by journalists being closer to the community! This was also the week that the Independent.ie reported that it would be introducing what Independent.ie called a “metred paywall” – how many metres tall will the paywall be, no-one yet knows.

Collaterlie Sisters of the Week

It’s bad enough for ordinary people to have to pay special attention to developments in the economy because those whose job it was to regulate and supervise key activities in the economy, cocked it up so badly in the last decade. But having to listen to the old media spewing out endless reams of figures, some weensy, some gargantuan really makes us feel like we’re listening to this all the time

But given we have to listen to all of this, isn’t it amazing that the old media has failed to inform us that we’ve slipped back into recession. Columnist Colette Browne was the first journalist in the Irish old media to inform the nation that we had returned to recession, this more than a month after the CSO confirmed two consecutive quarters of contraction of GDP. The Financial Times became the second old media outlet to do the same yesterday. Where were RTE, the Irish Times (“the paper of what have you”), the Independent and Examiner on 21st March 2013, when the CSO released its figures.

And yesterday, RTE managed to interview the CEO of Independent News and Media about that company’s annual results for 2012 and didn’t probe the debt restructuring which affects two state-owned banks which reportedly have exposure of €150m to IN&M. So we were given almost-bewildering facts about profits and losses and balance sheets but somehow our exposure to IN&M was overlooked.

Film refrain of the Week

“Captain, I’m giving her all she’s got, she’s breaking up, she can no take any more”

It’s not unusual to hear rages against austerity from individuals or the usual suspects, but this was the week when the planets aligned and giants in our cosmos all came out against austerity. We had the European Commission president, Manuel Barroso claiming austerity had reached its limits; we had SIPTU general president Jack O’Connor snaffling the entire €1bn saving in 2014 from the recent promissory note deal and claiming that for his members and he too was saying austerity wasn’t working; we even had business group IBEC warning against higher taxes and their impact on jobs. We had Minister for Social Protection and perhaps future Labour leader, Joan Burton criticizing austerity and its effects across Europe, and of course Ireland is still part of that Europe! We even had the lords spiritual wading in, with Archbishop Diarmuid Martin setting out the effect austerity was having on society.

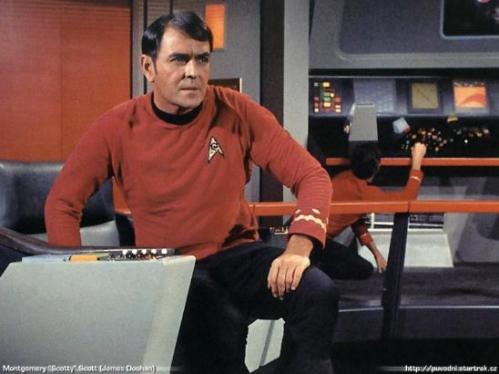

Unfortunately, there really isn’t much alternative to austerity in a currency union where the primary objective is price stability. If stimulus and growth could be achieved at the click of a finger, do you not think they would have been attempted already? We need to cut the gap between spending and income, so that as a nation, we can stand on our own two feet again. The best we can do is spread the period out over which we close the budget deficit gap, but unfortunately with debt:GDP already at 121% and a mighty €207bn of planned-debt by the end of this year, we really can’t spread the period out too much. At this stage, our problem is debt and unless we default, then unfortunately Michael “Scotty” Noonan has no choice but to give her some more but that doesn’t mean he doesn’t have choices in how the deficit gap is closed.

Table of the Week

Some good news this week from the Department of Finance which provided what it called “half-finalised” economic results for 2012 which showed that our deficit as a % of GDP in 2012 was 7.6% which was a full 1.0% less than the target we have with the Troika. Yes we had the windfall of the mobile phone licence and we had Minister Reilly acting the eejit with the health budget and we have slipped back into recession on the most modest basis in 2012, but all-in-all, the result shows the firm trajectory back to a balanced budget. Debt is planned to be €207bn at the end of 2013 though, and the betting on here is that we will have €1-3bn extra cost this year for IBRC’s liquidation and the jury is still out on NAMA with residential and commercial property prices still declining. Permanent TSB and AIB and even Bank of Ireland are not fully out of the woods, and may be back with the begging bowl. Somehow, Professor Morgan Kelly’s May 2011 estimate of €250bn debt doesn’t seem at all fanciful.

Chutzpah of the Week

Last Sunday, the tone on Twitter was lowered with the above promotional tweet from Ernst and Young. You might recall the Enda Farrell affair at NAMA when the now former NAMA employee firstly purchased a property owned by a NAMA developer without, according to NAMA, disclosing his interest and then in an investigation, the more serious matter of loan details being leaked by Enda was uncovered. What Enda had done was to send files to his wife Alice, who at the time occupied a senior position at Ernst and Young, and Alice forwarded the emails to Enda’s personal email address; that way, Enda bypassed controls at NAMA which stop information being sent to personal email address and the ruse also masked the leaking of the information. Alice has since left Ernst and Young, but how rich of E&Y to now promote its expertise in accessing and processing information! There was no response from E&Y to the comment above.

The Garda investigation of the information leaking appears not to have yet resulted into any arrest. NAMA was seeking costs for its court action against the formerly-golden couple, and Alice was defending the action by claiming she didn’t know the contents of the emails; that case appears to have settled without its terms reaching the media.

Unfit police service of the Week

And finally, the Belfast Telegraph reported last week that police chased a 59-year old man through a forest for 30 minutes before apprehending him. A 59-year old man wearing stockings and suspenders. And nothing else. For 30 minutes! The Dalai Lama certainly seems to have found it amusing above. In a suburb in south Derry which has attracted a reputation for gatherings of what might be called an unconventional nature, two PSNI officers responded to reports of there being a naked man about, and when they arrived at the woods in the Prehen area of the city, they chased the man for 30 minutes before finally apprehending him. Perhaps dope-cheating athletes should dispense with the steroids and the diuretics and just don stockings and suspenders, maybe the embarrassment-factor might be enough to power them to victory.

Do OMTs really exist?

Posted in Greece, IMF, Irish economy, Politics on April 26, 2013| 13 Comments »

“let me mention what has been, in our sense, the most powerful monetary policy instrument so far: the OMTs.” ECB president Mario Draghi at the monthly ECB press conference 4th April 2013

When the history of the European financial crisis 2007-onwards is eventually written, it may transpire that the solution turned out to be the promise of a fantasy which never became reality. Last year, the ECB president Mario Draghi announced a scheme termed “Outright Monetary Transactions” which were advertised as the ECB buying the sovereign bonds of countries. At its heart, the promise conflicts with the ECB’s primary objective of keeping inflation at, or near, 2% per annum, because if the ECB buys bonds it is printing new money and that leads to inflation. But the world, and more importantly, the markets swallowed the promise/threat and since then, bond yields have steadily fallen as the perceived risk of default has receded with the ECB regarded as a buyer of last resort.

This morning, one of the 17 central bank governors on the ECB’s governing council said “given that in the last few months we have had a kind of stabilisation, normalisation, maybe it [OMTs] will never be used” The governor of the Greek central bank, George Provopoulos was speaking in Athens today.

In Ireland, we would like some clarity on OMTs because in six months, our friends in the bailout Troika will write their last cheque and given we still have a €10bn annual deficit, we will need someone to lend to us. We have built up a buffer in the national exchequer and we will be able to finance ourselves to the end of 2014 using present projections, but at that point, we’ll be riding the bike without stabilizers and the concern is that the market won’t lend to us at sustainable interest rates. So we would like the backstop of OMTs.

Given we are exiting our bailout programme and that we have issued billions in long term bonds to a broad-based market in recent months, you would think we’re eligible for OMTs – those were the criteria stated by the ECB last year -but finance minister Michael Noonan keeps refusing to make that clear.

He was again asked this week if Ireland now qualifies for OMTs and again he says it is in the gift of the ECB. It’s an unsatisfactory situation and means we remain uncertain about our funding when the Troika packs up and leaves. And with one ECB member expressing doubt that they’ll ever be used, are OMTs just a fantasy accepted by an otherwise-hardnosed market?

The parliamentary question and answer are here.

Deputy Pearse Doherty: To ask the Minister for Finance further to the European Central Bank press conference on 4 April 2013 in which the President of the ECB, Mr Mario Draghi, referred to OMTs and their precise rules, his views that the rules surrounding the criteria for access to the Outright Monetary Transaction scheme are precise; and if so, if he will confirm if the State meets the criteria for accessing funding under the OMT scheme at this time.

Minister for Finance, Michael Noonan: As I informed the Deputy previously (Parliamentary Questions of 12th February 2013, (No. 211) and of 21st February 2013, (No’s 94 & 95)) the Governing Council of the ECB made a decision to establish the Outright Monetary Transaction (OMT) scheme on 2nd August 2012, and issued a press statement on 6th September 2012 which outlined its technical features.

According to this ECB Press Release, the purpose of OMT is: “Safeguarding an appropriate monetary policy transmission and the singleness of the monetary policy”

This press statement sets out that a necessary condition for OMT is strict and effective conditionality attached to an appropriate European Financial Stability Facility/European Stability Mechanism (EFSF/ESM) programme. Such programmes can take the form of a full EFSF/ESM macroeconomic adjustment programme or a precautionary programme (Enhanced Conditions Credit Line), provided that they include the possibility of EFSF/ESM primary market purchases. The ECB have also stated that OMT may also be considered for Member States currently under a macroeconomic adjustment programme “when they will be regaining bond market access”.

The ECB press statement also notes that the ECB’s Governing Council will decide on the start, continuation and suspension of OMT, following a thorough assessment, in full discretion and acting in accordance with its monetary policy mandate. The decision on whether to grant OMT or otherwise in any particular case is therefore a matter for the ECB.

I believe the ECB’s announcement regarding its OMT programme is a significant development and is viewed as such by the financial markets.

I also note Mr Draghi’s comments that one of the reasons why the ECB’s OMT scheme is successful “was because governments made significant progress in undertaking both fiscal consolidation and, in some cases, structural reforms.”

We are now in the final year of our EU IMF programme and our focus is now firmly fixed on a successful and durable exit from the programme. The recent highly successful sale of long term bonds by NTMA is another very significant step in this process. We continue to assess a number of options in this regard. However, we must respect the fact that the decision on whether to grant OMT or otherwise in any particular case is a matter for the ECB, which is an independent body.

Why is everyone so scared of the R-word?

Posted in Greece, IMF, Irish economy, Politics on April 22, 2013| 4 Comments »

“Recession: The commonly accepted definition of a recession in the UK is two or more consecutive quarters (a period of three months) of contraction in national GDP” HM Treasury glossary of terms

Ireland is back in recession.

We know that because the latest figures show that real GDP declined in the third quarter of 2012 compared to the second quarter and that the real GDP declined in the fourth quarter compared to the third quarter. The generally accepted definition of a recession is two consecutive quarters in which GDP contracts compared with the immediately-previous quarter.

The latest figures from the Central Statistics Office on 21st March 2013 show that in Q2, 2012 our real GDP* was €40,209m, in Q3, 2012 it was €40,045m and in Q4, 2012 it was €40,026m. The CSO reported the decline in Q3 as -0.4% and in Q4 as 0.0% though in Q4 it was really -0.047%. But here you have two consecutive quarters of decline in real GDP.

Why didn’t RTE refer to the recession-word in their reporting? I don’t know and I asked both David Murphy and Sean Whelan at RTE on Twitter if Ireland had slipped back into recession. Neither replied.

I also asked the BBC’s Jim Fitzpatrick the same question on Twitter who replied that yes, Ireland had slipped back into recession on the basis of its recent GDP statistics.

RTE is under constant attack from all sides about its partiality, and there may indeed be partiality in individuals but I think as an organization RTE is reasonably independent. The opinion on here is that the R-word is provocative and the fact that to one decimal place the figures in Q4,2012 were flat, gave RTE the cover to avoid the provocation. Remember on 21st March 2013, An Taoiseach Enda Kenny was in the USA selling the Irish comeback story, and if the national broadcaster back home was reporting a recession it would have pulled the rug from beneath him. And on the other hand, who would be upset if RTE didn’t use the R-word?

Outside RTE, much of the old media is teetering on the brink of collapse and desperate for more advertising spend and better circulation. So a headline with the R-word would just depress confidence and spending, and again, who would it upset if the R-word wasn’t used?

In the Dail last week, the Minister for Finance Michael Noonan was asked if Ireland was back in recession. It seems like a straightforward question and with two quarters of contracting GDP, it would seem equally straightforward to provide a clear answer. The response was hardly clear, though the Minister did acknowledge two quarters of contraction.

Now, it should be said that a conclusion of “recession” is regarded by some as requiring a wider analysis than just real GDP. Unemployment, retail sales, manufacturing, construction, exports are regarded by some as areas to be considered before concluding there is a recession.

The concern on here though is that we are soft-soaping the reality of our position, we still have a 7% deficit which is forecast to reduce to 2% in 2015 and this may not strike some as serious given our progress in reducing the deficit to date, but just look at our neighbours in the UK, they have a deficit forecast for 2013-2017 at 6.8%, 6.0%, 5.2%, 3.5% and 2.3%. We face an immense challenge, and ignoring the fact that we are back in recession is not helpful to honestly tackling the challenge.

The parliamentary question and reply are here:

Deputy Pearse Doherty: To ask the Minister for Finance if he will confirm that the economy is back in recession; and if he will make a statement on the matter.

Minister for Finance, Michael Noonan: The most recent data show that GDP contacted by -0.4 per cent quarter-on-quarter in the third quarter and by -0.0 per cent in the fourth quarter. In relation to the fourth quarter figure, the decline was very modest, and does not show up at the first decimal point.

Importantly, the same statistical release shows that domestic demand stabilised in the second half of 2012, with growth in consumer spending for the first time since 2010. The data-flow in recent months have also been positive on the domestic front as core retail sales have now been in positive territory in year-on-year terms in each of the last seven months. In addition, labour market data show increases in employment in the second half of last year.

My Department forecast GDP growth of 1.5 per cent for 2013 at Budget time. The main downside risks to this forecast remain beyond our control and relate to the external environment as well as some sector specific issues. Since then, a second successive year of negative growth has been forecast in the euro area given the simultaneous deleveraging and consolidation under way in so many euro area countries. A more prolonged downturn in our key international markets would negatively impact upon our export performance. Such a prolonged downturn could arise from a more protracted period of deleveraging or from any re-ignition of the sovereign debt crisis in the euro area.

My Department will publish revised forecasts at the end of April, taking into account all available information. [ENDS]

*real GDP referenced to 2010 and seasonally adjusted

Week Ahead 22nd-28th April 2013

Posted in Banks, Developers, Greece, Hotels, IMF, Irish economy, Irish Property, NAMA, Politics on April 22, 2013|

| General | |||||

| We MAY get NAMA’s management accounts for Q4,2012 | |||||

| Monday 22nd April 2013 | |||||

| CSO Govt Finance Stats Annual Results 2009-2012 (April 2013) | |||||

| CSO Govt Finance Stats Quarterly Results 2009-12 (Apr 2013) | |||||

| Tuesday 23rd April 2013 | |||||

| 10th Troika review mission starts, scheduled to last 2 weeks | |||||

| Punchestown festival starts, ends Saturday | |||||

| Wednesday 24th April 2013 | |||||

| 3pm IPD Irish commercial property index for Q1,2013 | |||||

| 2pm Fiscal Advisory Council at Oireachtas finance committee | |||||

| Bank of Ireland AGM Dublin | |||||

| Thursday 25th April 2013 | |||||

| CSO Livestock Slaughterings March 2013 | |||||

| CSO Residential Property Price Index March 2013 | |||||

| CSO Wholesale Price Index March 2013 | |||||

| Former minister & senator, Ivor Callely at Dublin district court | |||||

| Friday 26th April 2013 | |||||

| CSO Retail Sales Index Mar 2013 (Provisional) Feb 2013 (Final) | |||||

| Saturday/Sunday | |||||

| 27th April 2013 is the revised deadline for Sean Dunne to file | |||||

| his financial statements in his bankruptcy case in Connecticut | |||||

Increasing corporate tax rates: what was sauce for Cyprus is toxic for Ireland

Posted in Greece, IMF, Irish economy, Politics on April 21, 2013|

“Following the 25 March 2013 Eurogroup political agreement, additional fiscal consolidation measures of around 1.5% of GDP for 2013 will be legislated and implemented before disbursement of the first tranche of financial assistance, namely (i) increase in the statutory corporate income tax to 12.5%” draft bailout agreement for Cyprus 9th April 2013

You’ll recall how An Taoiseach Enda Kenny vehemently defended the Irish corporate tax rate in the face of flinty pressure from the French president Nicolas Sarkozy and less-obviously, from the German chancellor Angela Merkel in March 2011. There was the famous “Gallic spat” and the result of that was that Ireland missed out on an interest rate reduction on its bailout for another four months. When the interest rates were eventually reduced, the reduced rates applied to all bailout funding but the interest rate wasn’t back-dated – that “Gallic spat” cost us over €10m.

Ireland has an established global tax brand, it’s 12.5% and it’s not changing. This attracts colossal foreign direct investment by companies who want to exploit the low tax rate. For example, Google books half of its global revenues through its offices in Dublin. In 2011 Google Ireland booked €12.5bn of revenue and booked a gross profit of €9bn. It paid just €8m in corporation tax. This has less to do with Ireland’s 12.5% standard corporate tax rate than with the ability of global companies to have discretion in where they ultimately book profits.

But you might also recall that in the recent bailout discussions for Cyprus, a country which has an even lower headline corporate tax rate of just 10%, that Cyprus is being forced to raise its corporate tax rate by 25% in relative terms, from 10% to 12.5%. This change is supposed to improve Cyprus’s economy which, like Ireland’s, also depends on foreign direct investment.

So, why are Cyprus’s friends in Europe forcing it to increase its corporate tax rate, when such an increase is anathema to Ireland?

We don’t exactly know, but germane to the subject is a parliamentary question asked this week by Socialist TD, Joe Higgins of the Minister for Finance Michael Noonan who said that if Ireland were to increase its corporate tax rate by the same proportion as Cyprus, then the State would get €928m extra but only if companies didn’t change their behavior. Minister Noonan went on to say that foreign direct investment would suffer in Ireland and he went on to say “Recent research by the OECD also points to the importance of low corporate tax rates to encourage growth. “

But if that is the position in Ireland, why is it not also the position in Cyprus. Has Ireland overestimated the contribution to the well-being of our economy of foreign direct investment and its relationship with our tax rates, or are the Cypriots just too dumb to understand how their economy will suffer as a result of tampering its rates. Surely, only one answer is correct.

The parliamentary question and response are here:

Deputy Joe Higgins: asked the Minister for Finance the amount of additional revenue that will be raised for the Exchequer if the corporation tax rate here was raised by the same proportion, that is by 25%, as the increase to the Cypriot corporate tax rate in the original Cypriot bailout plan of 16 March 2013.

Minister for Finance, Michael Noonan: I am informed by the Revenue Commissioners that the full year yield to the Exchequer, estimated in terms of expected 2013 profits, of increasing the standard rate of corporation tax by 25% from 12.5% to 15.6%, is tentatively estimated on a straight line arithmetic basis to be about €928 million. While this estimate is technically correct it does not take into account any possible behavioural change on the part of taxpayers as a consequence. In terms of an increase in the 12.5% rate, estimating the size of the behavioural effects is difficult but they are likely to be relatively significant. An OECD multi-country study found that a 1% increase in the corporate tax rate reduces inward investment by 3.7% on average. On this basis, it would take only a 2.5% increase in the rate (to 15%) to decrease Ireland’s inward investment by nearly 10%. This assumes the average applies across the board but in fact the effect is likely to be more extreme for Ireland.

The very major importance of maintaining the standard 12.5% rate of corporation tax to Ireland’s international competitive position in the current climate must also be borne in mind. Ireland, like other smaller member states, is geographically and historically a peripheral country in Europe. A low corporate tax rate is a tool to address the economic limitations that come with being a peripheral country, as compared to larger core countries. Ireland’s low corporation tax rate plays an important role in attracting foreign direct investment to Ireland and thereby increasing employment here. Recent research by the OECD also points to the importance of low corporate tax rates to encourage growth.

Further, it would be difficult to justify such a move in the context of Ireland’s stated position that we will not change our corporation tax strategy. Even a marginal change would undermine both our long held stance on this issue and the certainty of business, domestic and international, in our resolve to maintain that position.

The billions we could have saved if we acted earlier against the bondholders

Posted in Banks, Greece, IMF, Irish economy, Politics on April 21, 2013| 3 Comments »

Later this morning, the protesters of Ballyhea and Charleville will hold their 111th weekly protest march, starting from the library Plaza in Charleville at 11.30am, it will be the usual 15-minute march to highlight the billions of euros which have travelled via a circuitous route from our pockets to the Government to the banks, ultimately to the bondholders. The protest has certainly grown and there are now similar protests in Tralee, Killarney, Clare, Wicklow, Ratoath and Skibbereen. The sensitivity of the protesters who instinctively know that possession is nine tenths of the law when it comes to this money, our money, contrasts with An Taoiseach claiming that banks are paying bondholders “out of their own resources”

Two recent events have shown us just how much this State might have saved if these issues at the heart of these protests had been recognized by the decision-makers in government. In February 2013, we liquidated Irish Bank Resolution Corporation which will now see a small number of bondholders, estimated on here to be €100-200m burned, though it will also see credit unions losing €15m and Irish pension funds losing €1m. When this government came to power in 2011, there were nearly €4bn of senior unguaranteed bonds at IBRC alone, and practically all have now been 100% repaid. You might recall the protestations at these repayments, here was the scene in the Dail in November 2011 when a USD 1bn bond was being repaid at Anglo, Sinn Fein and most of the Independent deputies walked out in protest.

The second event was the bailout of Cyprus where we saw that Cyprus itself made the decision, rubberstamped by the Europeans, to burn depositors with deposits less than €100,000 even though they were guaranteed, though that decision was later reversed by the Cypriots themselves. We were also reminded that sovereign EuroZone countries still retain fiscal powers and can levy taxes, so we’re now scratching our heads as to why this Government didn’t introduce a 100% tax on unguaranteed senior bondholders when it came to power in March 2011.

In the Dail this week the Sinn Fein finance spokesperson Pearse Doherty asked Minister for Finance Michael Noonan to confirm the senior bondholders in Irish banks when he came into office and also why he didn’t impose large taxes on payments to such bondholders. Judge the responses below yourself, but they just appear to show how stupid we have been and how we have let billions slip through our fingers which we will be repaying for decades to come.

There are still some meaty bonds left at AIB, PTSB and Bank of Ireland but the bulk of the easier-to-burn bonds have been repaid. The Ballyhea protesters will shortly be updating their demands and focusing on the €25bn of sovereign bonds given to the Central Bank in February 2013 as part of the IBRC liquidation, but when the story of this phase in our State’s history is written, the Ballyhea protesters and those like them will be seen as prescient and engaged, contrasting with ignorant and incompetent government which could have liquidated IBRC in March 2011, and which could have used its sovereign fiscal powers to impose taxes on bondholders at other banks in receipt of bailouts.

Here are the parliamentary questions and responses

Deputy Pearse Doherty: To ask the Minister for Finance if he will provide an assessment of the overall cost to the State of the bailout of Permanent TSB; if senior bondholders had been wiped out in March 2011.

Deputy Pearse Doherty: To ask the Minister for Finance if he will provide an assessment of the overall cost to the State of the bailout of Anglo Irish Bank and Irish Nationwide Building Society, if senior bondholders had been wiped out in March 2011.

Deputy Pearse Doherty: To ask the Minister for Finance if he will provide an assessment of the overall cost to the State of the bailout of Allied Irish Banks and the Educational Building Society, if senior bondholders had been wiped out in March 2011.

Deputy Pearse Doherty: To ask the Minister for Finance further to Parliamentary Questions Nos. 179, 180, 188 and 227 of 26 March 2013, to which he, in part, responded the Eurogroup advised against this proposal, but it recognised that fiscal measures such as taxes and levies are matters for individual member states, whether in a programme of assistance of not, if he will provide an assessment of the benefit that would have flowed to the State if a 99% tax or levy had been imposed on senior unguaranteed bondholders in Anglo Irish Bank and Irish Nationwide Building Society from March 2011..

Minister for Finance, Michael Noonan: I propose to answer questions 219, 220, 221 and 250 together.

The Deputy will be aware that when this Government took office it attempted to enforce burden sharing with senior unguaranteed bondholders in particular institutions that were no longer core elements of the Irish financial system. Intensive discussions were held with our European partners and particularly President Trichet of the ECB in the run-up to the announcement of our stress tests on 31st March 2011. At that time the President believed that such action was not in the interests of Ireland or the Euro Area. This matter was discussed again with President Trichet on a number of occasions including the Ecofin meeting in Poland in September 2011.

The Central Bank of Ireland has advised me that as of 18th February 2011, the total unguaranteed senior debt issued by the covered institutions was €36,452m of which €20,039m was unguaranteed senior secured and €16,413m was unguaranteed senior unsecured (This information was published to the Central Bank of Ireland website in April 2011).

Within these figures, the amount outstanding at Anglo Irish Bank and Irish Nationwide combined was €3,748m (unguaranteed senior unsecured), while there was no senior unguaranteed secured notes in issue.

As the Deputy is aware, burden sharing was thus restricted to junior debt, which over the course of the crisis contributed over €15bn in capital to the Covered Institutions.

Central Bank on a collision course with banks over accounting standards

Posted in Banks, Greece, IMF, Irish economy, Politics on April 20, 2013| 8 Comments »

“the Central Bank is minded to require credit institutions to set the present value of future cash flows at zero other than those arising from disposing collateral for the purpose of calculating the amount of the impairment provision required, without exception, for all loans in arrears greater than 90 days which have not been subjected to restructured arrangements on a sustainable basis at the time of assessment” Central Bank of Ireland publication “Mortgage Arrears Resolution Targets 13th March 2013”

You might recall the fanfare of the announcement on 13th March 2013 when the Department of Finance announced it was finally getting serious with banks over distressed mortgages. Targets – which appear fanciful on here with the banks supposed to provide sustainable solutions to 25,000 mortgages by the end of June 2013 – have been set for the banks. And Minister for Finance Michael Noonan says that the Central Bank now has a stick with which to warn the banks, and hold them to account and that stick is that the Central Bank can force the banks to write down the value of loans to the underlying asset.

Let’s explain that.

If Bank of Ireland has loaned you €300,000 on a 25 year mortgage for a property that is now worth €200,000 and you have fallen behind on your payments and are in arrears. Then, under the Government’s targets, Bank of Ireland has to propose a sustainable solution for you. That may mean that Bank of Ireland places you on interest-only for a period of time or reduces your monthly payment in some other way, and in some instances, may give you a payment holiday. We don’t know exactly was “sustainable” means but you get the idea.

Now, if Bank of Ireland fails to provide you with a “sustainable solution” then the Central Bank is going to force Bank of Ireland to write down the value of the €300,000 loan in its books to €200,000. That means Bank of Ireland has to book a loss of €100,000 and if Bank of Ireland has big enough losses overall with other peoples’ mortgages, Bank of Ireland may become insolvent and need more capital – that’s the stick. As the borrower of the €300,000 mortgage, don’t get excited by the above, you still owe the €300,000 – unfortunately, it’s just the bank that books the €100,000 write-down.

All straight-forward so far?

Here is where it gets messy for the Government, the Central Bank and the banks.

Banks in Ireland, and in fact all businesses that produce public accounts, comply with accounting standards. At present, when Bank of Ireland produces its accounts, it is required to look at your €300,000 loan and because you are in arrears, it needs to estimate what the loan is worth. At present, Bank of Ireland estimates how much cash it will receive in future from you and also what the value of the property is. So, if Bank of Ireland thinks that you have temporary difficulties and will make reduced payments for the next five years and then get back to full payments, it will probably value the loan at €300,000 because it figures that between the repayments and the value of the property if it repossesses it, it will get back its €300,000.

This valuation of your loan by Bank of Ireland is governed by International Financial Reporting Standards and specifically International Accounting Standard 39. And that’s what banks here use when producing their accounts. But what is now envisioned is that the Central Bank can intervene to direct banks to write down the value of a mortgage to the value of its underlying security, regardless of whether or not the bank thinks it can get more money out of you.

This new approach is only to kick in from January 2014, but this represents a serious interference by the Central Bank into accounting practice and the view on here is that banks can tell the Central Bank to “sod off” and that banks will continue to prepare accounts in the old manner and those same accounts will be audited and approved by accountants. Of course the Irish banks are mostly owned by the Government, so they may yield to this arm-twisting, but Ulster Bank and KBC for example are more independent, and I don’t think the Belgian government will think too kindly on a demand for more capital for its Irish operation because the Central Bank wants to subvert international accounting standards.

Or, in other words, the main threat to the banks for failing to meet targets, is almost completely hollow.

The information reported above is in part derived from two parliamentary questions by the Sinn Fein finance spokesperson to Minister Noonan, these are the two questions.

Deputy Pearse Doherty (26th March 2013): To ask the Minister for Finance further to his announcement on mortgage arrears on 13 March 2013, if financial institutions will continue to prepare their accounts under International Financial Reporting Standards, and particularly if the requirement to write down the value of certain loans to the value of the underlying security, will lead to the necessity for banks to produce two sets of accounts.

Minister for Finance, Michael Noonan: The Central Bank has informed me that its publication on Mortgage Arrears Resolution Targets, which can be accessed on the Central Bank’s website at http://www.centralbank.ie, addresses the use of IFRS standards in the context of MARS targets and on page 16 states:

“An entity which prepares their financial statements in accordance with International Financial Reporting Standards (IFRS) is required to comply unreservedly with all of the requirements of those Standards. The Central Bank is conscious that its guidelines in respect of provisioning against impaired loans must be consistent with those standards and is satisfied that the approach to provisioning set out below meets that consistency requirement.”

Deputy Pearse Doherty (16th April 2013): To ask the Minister for Finance further to Parliamentary Question No. 193 of 26 March 2013, the way advertised threat of forcing banks to write down the value of problem loans to the value of the underlying security is any different to pre-existing requirements under International Financial Reporting Standards and particularly International Accounting Standard 39..

Minister for Finance, Michael Noonan: The Central Bank has informed me that it is minded to require credit institutions to set the present value of future cash flows at zero other than those arising from disposing collateral for the purpose of calculating the amount of the impairment provision required. This applies without exception, to all loans in arrears greater than 90 days which have not been subjected to restructured arrangements on a sustainable basis at the time of assessment.

This will force credit institutions to value assets on their books which are 90 plus days in arrears and not sustainably restructured based on the expected net proceeds of collateral disposal only. Credit institutions would not be allowed to incorporate assumed or expected future cash flows from other sources into these valuations as may be the case currently.